On the fact that Bitcoin has a Kill Switch; and how to disconnect it.

“There are three classes of people: Those who see. Those who see when they are shown. Those who do not see.”

(Attributed to Leonardo da Vinci.)

It is widely understood that early adopters of Bitcoin, who showed up on the scene in the days when mining difficulty was low, are sitting pretty, and will continue sitting pretty without ever having to do much of anything ever again. And so, skeptics often describe the system as a Ponzi scheme. The Bitcoin FAQ addresses this accusation thus:

Early adopters have a large number of bitcoins now because they took a risk and invested resources in an unproven technology. By so doing, they have helped Bitcoin become what it is now and what it will be in the future (hopefully, a ubiquitous decentralized digital currency). It is only fair they will reap the benefits of their successful investment. In any case, any bitcoin generated will probably change hands dozens of time as a medium of exchange, so the profit made from the initial distribution will be insignificant compared to the total commerce enabled by Bitcoin. Since the pricing of Bitcoins has fallen greatly from its June 2011 peak, prices today are much more similar to those enjoyed by many early adopters. Those who are buying Bitcoins today likely believe that Bitcoin will grow significantly in the future. Setting aside the brief opportunity to have sold Bitcoins at the June 2011 peak enjoyed by few, the early-adopter window is arguably still open."

Bitcoin FAQ. "Is Bitcoin a Ponzi scheme?" "Doesn't Bitcoin unfairly benefit early adopters?"

I do not deny that the creators of Bitcoin deserve some reward for taking the trouble to create an elegant and, for the most part, mathematically-sound decentralized cryptocurrency. Yes, they "bought Manhattan for a quarter." And some people find this off-putting. But such objections are rooted mainly in envy. Everyone wishes that they, rather than the founders, had pulled off the early land grab. Debates about how much the founders "deserve" to profit from their foresight are largely an exercise in pointless bickering. Count me out.

But the real problem with Ponzi schemes - and the reason why they are considered a legally-actionable type of fraud in every civilized country - is not the abstract unfairness of some clever fellow getting "something for nothing." Rather, it is the fact that such schemes come with a built-in self-destruct mechanism, whereby at a certain point, those who sit on the apex of the pyramid decide to cash out, pocketing nearly all of the meatspace wealth previously invested into the system.

A Ponzi scheme is generally agreed to be a Bad Thing, and most Bitcoin enthusiasts do not like the idea of being involved in one. They vigorously deny the possibility that Bitcoin has a removable "floor," which might one day "fall out" and permanently transfer ever penny's worth of traditional money, precious metal, alpaca socks, cocaine - and everything else which has been exchanged for bitcoins - into a handful of pockets.

Unfortunately, the facts speak for themselves. One of the world's greatest cryptographers published the following analysis:

Dorit Ron and Adi Shamir, Quantitative Analysis of the Full Bitcoin Transaction Graph. (Mirror)

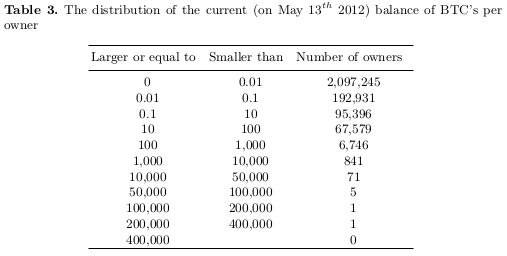

By the nature of the system, the ownership history of every bitcoin in existence is public. Ron and Shamir found that a sizeable bulk of the Bitcoin transaction history to date consisted of shell game switcheroos, designed to conceal certain inconvenient facts. And it should surprise no one that, once the fog of deliberate obfuscation clears, we see the following distribution of ownership:

Most bitcoins are, in fact, in the hands of a very few people. Are you surprised? I'm not.

We also learn that, of the approximately 9 million bitcoins which currently exist, less than 2 million actually circulate - that is, change hands with any appreciable frequency:

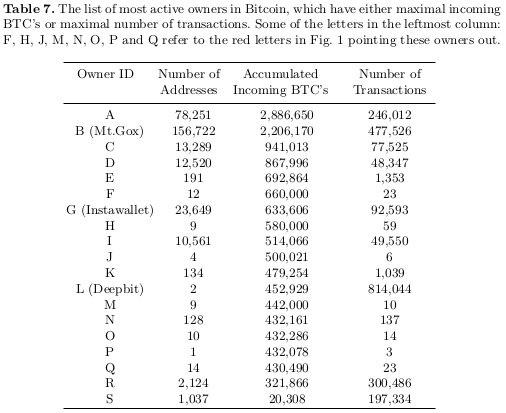

And it would appear that most of the non-circulating coins are in the hands of a very small number of people - who, one may reasonably suspect, were involved from with building and propagandising Bitcoin from its very beginning. So, who are the lords of Bitcoin?

Who, one might wonder, is "A" ? Satoshi Nakamoto? I doubt that we'll ever know for sure. And I'd bet serious money that "R" and "S," with their astronomical transaction frequencies, are botnets specializing in the theft of CPU/GPU cycles for mining (and unguarded Bitcoin wallets.) These are known to exist.

But the most damning fact revealed in the paper is not the extreme top-heaviness of the Bitcoin ownership pyramid, but rather the elaborate lengths to which the hoarders went in order to conceal their existence from "rank and file" users. Think of it! Hundreds of thousands of shill accounts, with vast rivers of wealth moving back and forth - for one purpose only: to deceive. None of it was done by accident.

And perhaps the most interesting thing to be learned here is not in the paper itself, but rather in the reaction of the Bitcoin user community. This, in short, is summed up by the reply of a suspect in a stereotypical "whodunit" story, who, when confronted with an accusation of murder, often says: "He ain't dead, and if he is, I didn't kill him, and if I had, the bastard had it coming."

Hundreds of people are busy pointing out largely-imaginary flaws in Ron and Shamir's paper. They conveniently ignore the fact that the data set is entirely public, and if they disagree with the stated conclusions, they are welcome to perform a similar analysis and try to produce different ones. But no one has done so, and I dare to predict that no one will. On the other hand, those who acknowledge the revealed facts are busy insisting that the hoarders could not possibly harm other users by dumping their coins on the market in the future. All right, maybe you can't do arithmetic. Brain damage happens, and we should feel sympathy for you. But some of us can. And arithmetic doesn't lie.

Some people are incensed by "hoarders" - not I. I don't give a damn. At least Bitcoin hoarders never had to kill anyone to obtain their wealth, unlike those who control land and other natural resources. The problem here is a much more concrete one: Bitcoin turns out to be something other than the fully-decentralized, unkillable network which so many imagined it to be.

People who have invested serious time and wealth in Bitcoin ought to feel angry. Not from any abstract sense of fair play, but from the simple fact that Ron and Shamir's findings reveal a serious - and quite mathematically-certain - flaw in the sytem. The total number of bitcoins in actual circulation is much smaller than previously believed. If the early adopters were to cash out and place their hoards on the market, the exchange rates (as denominated in anything) would dive through the floor, never to recover. The hoarders, in effect, possess an off switch for Bitcoin.

Whether and under what circumstances they would press the switch, I cannot say. But the Bitcoin kill switch exists.

So, what, if anything, could be done about it? Unfortunately, the one solution which I can think of (other than the idiotic head-in-the-sand solution of not giving a damn, which the Bitcoin user community seems to favour) is a rather unlikely one, and would be quite distasteful - on a gut level - to most users. I am speaking, of course, of proscription. If the Bitcoin community - or a reasonable subset thereof - agreed that the kill switch ought to be neutralized by any means possible, it would be a fairly straightforward matter to declare the hoarders persona non grata and collectively agree to use modified Bitcoin clients (let's call them Bitcoin-P) which act as if the particular coins currently held by A, C-F, H-K, and M-S were not bitcoins at all. And that such pseudo-coins will never be accepted as genuine in trade for any good or service. In effect, they would be retroactively shitcoined for all time.

This act would not require cooperation from every single Bitcoin user, or the imposition of any kind of governing authority. If even a minority of users were to move to Bitcoin-P, operating separate exchanges and the like, said users would be forever immune to the effects of a future market glut resulting from hoarders cashing out. Users of conventional Bitcoin would feel the effects in full, suffering the loss of most if not all of their purchasing power.

But I am under no illusions that Bitcoin-P will ever happen, given the libertarian bent of most Bitcoin users. They will mutter of dekulakization and the like. Fine, lose your hard-earned wealth to a pyramid scheme operator at some unspecified future date. But if you like the idea of decentralized cryptocurrencies without built-in kill switches, think hard about Bitcoin-P. Anyone who wants to can start using Bitcoin-P right now, without having to wait for others to be convinced of its merits. Just compile a list of the Satoshi gang's bitcoins, and start pretending that they aren't coins at all. It really is that simple.

Or better yet, consider the possibility of entirely novel mathematical schemes for "digital gold," which have yet to be discovered. The field has a delightfully rich history, and perhaps great things await the honest and enthusiastic amateur cryptographers willing to take on the challenge.

Edit: Apparently people still think that I have some sort of religious problem with "hoarders" per se. I couldn't care less whether you sit on your coins or spend them, or how many you presently have. The problem with the Satoshi gang's hoard in particular is not simply the size of the latter. It is rather that Satoshi and his friends never had to put U.S. dollars, gold, cocaine, alpaca socks, etc. into the system in order to obtain their coins. They are collectively sitting on top of a massive cheque that the Bitcoin economy probably could not ever cash without bleeding to death. So if this handful of people were to decide that they're done with Bitcoin, then Bitcoin will be done with itself.

And in the interest of full disclosure, I presently own a total of ~0.1 BTC. (If you're willing to take my word for it.) I mined the damn stuff with a Xilinx "Virtex 5" FPGA. It was a total waste of time, but writing the miner made for good Verilog / general logic layout skills practice.

I have a bitcoin address showing over 1200 'BTC received' according to blockexplorer - yet has only ever had less than 40BTC in it, which through various small transactions has been whittled down to less than half that in final balance. It did not receive 1200 BTC in any real sense - it was the same BTC roving through the addresses in my wallet through the machinations of the change mechanism.

Presumably the more active your wallet - the more often large 'change' amounts go back into it and are counted as 'received'.

Now I admit it's not clear to me what 'Accumulated incoming BTCs' in table 7 above means - but as the total of that handful A to S above comes in at around 14Million at a time when there are 10Million or so BTC in existence - it seems to be potentially misleading.

Why postulate that address A is anything other than a high transaction merchant or exchange like the similar B which is MtGox? Obviously the 2.8Milion 'Accumulated incoming BTC' does not represent a holding in any sense - as the 14Mill total demonstrates.

Similarly when we look at Table 2 in the paper - just taking the 76 owners of >400K 'accumulated incoming' BTC - we get 30.4M so perhaps 'total' would be a better word than 'accumulated'?

You say " act as if the particular coins currently held by A, C-F, H-K, and M-S were not bitcoins at all "

Perhaps you are confusing these highly active accounts with the *current balance* holders in table 3?

Given that my own address with a modest 100 transactions or so shows a 1 to 30 difference between actual BTC holdings and what blockexplorer and blockchain.info perceive as 'received BTC' - it hardly seems valid to accuse A to S of high current balances, especially those with large numbers of transactions.

That most if not all of them might be Bitcoin services holding amounts on behalf of many users doesn't seem to rate a mention - but is clearly true for the 3 identified.

It also seems disingenuous to include the high balance 'holders on the behalf of many' as the 'rich' and the 2 million+ sub 0.01BTC as the 'poor' in any meaningful perception of a 'wealth pyramid'.

I've often donated 0.01 or less as tips to various people and just 'demos' of how it works. It seems likely to me that a significant number of these people aren't really 'using' Bitcoin in a serious sense - they've just tried it out.

Dear jjj,

> It also seems disingenuous to include the high balance ‘holders on the behalf of many’ as the ‘rich’ and the 2 million+ sub 0.01BTC as the ‘poor’ in any meaningful perception of a ‘wealth pyramid’.

Read Ron and Shamir's paper. The "rich" aren't simply holders of high balances. They are holders of high balances which were never spent and which appear to originate entirely from early mining. And, most damning of all, these people have carried out an elaborate obfuscation project involving hundreds of thousands of shill accounts. What are they hiding, and from whom?

> I’ve often donated 0.01 or less as tips to various people and just ‘demos’ of how it works. It seems likely to me that a significant number of these people aren’t really ‘using’ Bitcoin in a serious sense – they’ve just tried it out.

It would appear, then, that around 75 users are actually "using" Bitcoin. Do you see anything wrong with this picture?

Yours,

-Stanislav

Dear Stanislav,

If we cut out the 2Million+ sub 0.01 accounts *and* the 193K sub 0.1 accounts - we still have over 170,000 'owners' as described in Table 3.

When you say 'it would appear, then, that around 75 users are actually "using" Bitcoin' - I'm going to very charitably assume you're just having fun... but, yes there is something very wrong with the picture *you* are attempting to paint.

Dear jjj,

Ron and Shamir tell us that there are about 75 people on Planet Earth who move Bitcoins from one address to another with any appreciable frequency. If you have derived a different number, please tell us what this number is, and how you came by it.

Yours,

-Stanislav

You seem to be casting your own interpretations with a phrase like "any appreciable frequency" - which is not an idea the papers authors were getting across. The authors stated that it was 'remarkable'.

Perhaps you consider my modest 100 bitcoin transactions as not appreciable - but it is comparable to some traditional bank accounts I have held over similar periods. That such numbers may be dwarfed by high transaction accounts run by businesses is immaterial.

That the top transactors do so at a rate much higher than most is entirely consistent with the case that these represent automated wallet and exchange systems.

Not giving a damn still prevals in Bitcoin community. What a bunch of idiots.

If bitcoin proves to be a useful medium of commerce, then the fact that early adopters get rich won't matter. If not, then the none of this matters. If Dr. Evil sells his gigantic mass of bitcoins at some critical moment, the entire bitcoin project will collapse wiping out countless small bitcoin holders? I guess it's possible, sort of like if China decides to dump all its US bonds onto the market at once. But it only would matter for those who hold bitcoins as an investment; hopefully those folks know that investment involves risk and have hefed their bets. But ultimately bitcoin will only be important if it becomes a widely used medium of commerce, and if that happens Dr. Evil won't matter.

Dear Tom,

> But it only would matter for those who hold bitcoins as an investment

Everyone who purchased bitcoins did so as an investment - even those who intended to spend them immediately. Let's say that you bought a hundred BTC with the intent of buying a thousand alpaca socks. Dr. Evil releases his hoard in the few seconds between your transfer of USD to Mt. Gox and your planned sock purchase. All of a sudden, you discover that you've invested 1000 USD to buy one alpaca sock. Will you be happy about this?

> But ultimately bitcoin will only be important if it becomes a widely used medium of commerce, and if that happens Dr. Evil won’t matter.

Presumably Dr. Evil will carry out his evil deed long before a sufficient number of Bitcoins is mined to wipe out the early miners' advantage. At least if the early miners have any brains - which they most assuredly do.

Also consider the possibility, discussed in my earlier post, that Bitcoin is an NSA honeypot (or some other organization's long-term plot to discredit the basic idea of a cryptocurrency.) In that case, "Dr. Evil" isn't trying to get USD-rich: the kill switch is just that: a kill switch. And so, the switch will be thrown in the event that Bitcoin starts to take off and it is time to bring the honeypot experiment to a close.

Yours,

-Stanislav

This "easy" solution has one obvious flaw - new clients have to be distributed to majority of mining power in such way that the "Satoshi gang" is unable to do anything about it. Otherwise they can dump bitcoins preemptively or disrupt everything in some other way.

But I think there is already another existing solution - the Litecoin.

* It started with many more users and miners than bitcoin -> less centralization.

* The scrypt function it uses isn't so easy to optimize by parallelization/by using special hardware. Solo mining is still somewhat viable.

Dear jurov,

> new clients have to be distributed to majority of mining power in such way that the “Satoshi gang” is unable to do anything about it.

We can find out which coins are in the Satoshi hoard right now. And retroactively declare them (and any mixer descendants) invalid. And there is no need for the majority of users to do this. If only a hundred users do it, it will still disable the kill switch for said users, assuming of course that this group of users operates at least one USD-BTC exchange. Exchange rates will drop like a rock on every other exchange when the hoard floods the market, while the Bitcoin-P exchange remains untouched.

> Otherwise they can dump bitcoins preemptively or disrupt everything in some other way.

What do you suppose they could do, other than crying hysterically? Dumping the coins won't harm Bitcoin-P users, regardless of whether it is done right this very minute or a decade from now, because said users can identify hoard coins and refuse to recognize them as genuine.

Yours,

-Stanislav

I don't think the experiment you are suggesting has ever been tried. To suggest that it would be a completely independent exchange rate from the underlying currency is I think a very big assumption and I would also think it would not have many adopters as it is obvious that people would just keep doing it as there were more and more balances that others didn't like. I doubt it would ever catch on why not create a completely different crypto currency? I am also still not convinced these are balances because of more bitcoins being in the aggregate then were actually available at the time. Regardless if they cash out those that have pulled out of bitcoin before the cashout will do well and those that buy in after the cash out will do well. If the currency is adopted by a large enough populace it won't matter when they hit the kill switch. Some will make money from it some will lose and it will continue to go up and down after.

[...] by alexkravets link 4 [...]

Tell me again how you can know who is the current holder of bitcoins sent to an address that had never before received funds and which remain unspent?

Also, can the funds held in cold-storage by an exchange be differentiated from funds held by someone as their savings?

Dear Anonymous,

> Tell me again how you can know who is the current holder of bitcoins sent to an address that had never before received funds and which remain unspent?

If you want an exact answer, I'm afraid you will have to ask the good doctors Ron and Shamir to tell you how they rolled up the graph and traced shill accounts to a small set of original true addresses.

> Also, can the funds held in cold-storage by an exchange be differentiated from funds held by someone as their savings?

Presumably it is fairly easy to determine which coins were mined by the early miners, and go on from there. It isn't the "savings" aspect that is interesting, but rather the fact that most coins in existence appear to be those owned by the early miners, and which, it turns out, were never spent and circulated.

Yours,

-Stanislav

Don't let the big names prevent you from making some proofreading.

https://gist.github.com/3901921

"If the early adopters were to cash out and place their hoards on the market, the exchange rates (as denominated in anything) would dive through the floor, never to recover. The hoarders, in effect, possess an off switch for Bitcoin."

Uh, sure, prices would drop off significantly, but prices would never recover? That seems pretty unreasonable, considering we've already seen a massive drop and a subsequent price recovery. If that 78% hoard decides to sell their coins, the price dips to pennies, buyers get to buy cheap Bitcoins, and the Bitcoin network continues. Simple as that.

It's likely that the reason these major Bitcoin holders are 'hoarding' their coins because they believe their coins will continue to appreciate. If they didn't dump them at $30/BTC, apparently the owners feel that their coins will eventually be worth more than that.

Dear YeahSure,

You are assuming that the early adopters are necessarily in the business in order to get rich. If "Satoshi" is actually an NSA bureaucrat, he may be waiting until Bitcoin is at a particularly vulnerable political moment to dump his hoard and open the scuttling valve.

And at any rate, why not let the exchange rate grow for a while before cashing out? The founders will wait until there are $billions of actual U.S. dollars circulating in the exchanges before pushing the button, so as to vacuum up as many of them as possible.

Yours,

-Stanislav

Why would it matter if Satoshi is just somebody looking to profit or from the NSA? My point remains:

1) Large amounts of Bitcoin are sold, decreasing the price significantly (perhaps down to pennies)

2) People buy cheaper Bitcoins

3) The Bitcoin network goes on

The price of Bitcoin has ZERO effect on network's ability to function as a payment system, so there is no reason to think that a dramatic price drop would be a "kill switch" to Bitcoin.

The best example is Silk Road; they aren't going to stop using Bitcoins, and the price of Bitcoin is irrelevant thanks to their hedging system.

Dear YeahSure,

Why do you think that #2 will happen?

Have you never heard of a panic sell-off, or a bank run, with permanent consequences?

Or, for that matter, of hyperinflation? (The Satoshi hoard being released would be similar in its effects to Weimar Germany's printing money and multiplying the size of the monetary supply.)

Yours,

-Stanislav

"If even a minority of users were to move to Bitcoin-P, operating separate exchanges and the like, said users would be forever immune to the effects of a future market glut resulting from hoarders cashing out."

No. If you want to trade your coins with someone still part of the majority accepting existing coins, they will value your coins at the post-inflation price. And once all those coins have been dumped into circulation, no way are the larger number of users going to want to declare them worthless.

Your analogy to hyperinflation is wrong. Hyperinflation is not about one-time increases in the money stock. It is about the belief that there will be accelerating inflation in the future so you'd better minimize your currency balance and trade for goods right now. It typically occurs when a government cannot cover its bills through taxation & borrowing and so must resort papering over the gap. That is not the situation with BitCoin, where a publicly known algorithm sets the total stock.

Dear TGGP,

> No. If you want to trade your coins with someone still part of the majority accepting existing coins, they will value your coins at the post-inflation price. And once all those coins have been dumped into circulation, no way are the larger number of users going to want to declare them worthless.

They won't be worthless, but they will be worth considerably less than one could get for Bitcoin-P coins on Bitcoin-P exchanges. Assuming that Bitcoin-P existed and operated separate exchanges (exactly identical to ordinary Bitcoin exchanges aside from the fact that certain coins are proscribed there and cannot be exchanged for traditional money - and naturally will never be dispensed as payment for incoming traditional money in a Bitcoin-P exchange, as there is no way for the latter to come into possession of such coins.)

If you are Satoshi Nakamoto, don't worry - there is no reason to think that anyone will actually bother to build Bitcoin-P. I suggested it as a thought experiment. (Although if someone were to build it, and if I were to become a serious Bitcoin user, I personally would prefer to use Bitcoin-P over conventional Bitcoin. The only thing one could possibly lose by using Bitcoin-P is a little bit of liquidity. While the "Satoshi-Crash" protection is nice.)

> Your analogy to hyperinflation is wrong. Hyperinflation is not about one-time increases in the money stock. It is about the belief that there will be accelerating inflation in the future so you’d better minimize your currency balance and trade for goods right now. It typically occurs when a government cannot cover its bills through taxation & borrowing and so must resort papering over the gap. That is not the situation with BitCoin, where a publicly known algorithm sets the total stock.

Technically you are right: hyperinflation is the wrong term here. We are talking about an ordinary market crash:

Consider the following scenario. On Earth, platinum is a considerably-rarer substance than gold. In fact, all of the platinum ever mined would scarcely fill a swimming pool. What do you suppose would happen if someone were to come across a gigantic and previously-unknown deposit of the metal? This is certainly possible, considering that asteroids rich in platinum have been found in the past. Let's say that the world supply of platinum were to quadruple overnight. Would the price of the metal fall by the same factor? I don't think so. All of a sudden, quite a few rich people who have stored substantial wealth in the form of platinum would stampede and jump over each other's heads in a rush to get their savings out of the suddenly-cheapened storage medium. So the price would fall catastrophically, by a factor far greater than four, and in the end would be stabilized only by increasing demand from industrial users (auto industry's catalytic converters, pharma industry's cisplatin, etc.) and it would be a long time before anyone would suggest keeping one's life savings in platinum.

Stampedes happen, because humans are, unfortunately, herd animals. Bitcoin had already weathered a stampede once, but a far greater one may be in the making.

Yours,

-Stanislav

One obvious flaw in BitCoin's design is that it is a virtual gold--that is to say, a commodity--rather than a virtual currency per se. If the price of currency drops dramatically, the issuing bank or central bank can contract the supply in order to stabilise the price. Enforcing this mechanism was, in fact, the aim of the gold standard. BitCoin possesses no such apparatus.

#2 will happen because there are certain markets which can ONLY and EXCLUSIVELY use Bitcoin for transactions (the Silk Road example is just one).

So long as Bitcoin serves a purpose that no other transactional system or currency can do, people will buy Bitcoin.

Someone wants to send $2 to a relative in China instantly? Only Bitcoin can do that. Want to perform a global trade in escrow with zero fees? Only Bitcoin can do that. Want to gamble a fraction of a penny on a game or play online poker in the US? Only Bitcoin can do that.

When Weimar's currency hyperinflated, it had no use in any market. Bitcoin has uses regardless of price.

Dear YeahSure,

All of this is true. Some kinds of transaction are quite impossible to carry out using traditional banking systems, and can only happen using Bitcoin or something like it.

However, if Bitcoin were to crash due to panic resulting from a Satoshi Hoard Sell-Off, some other system (such as Bitcoin-P) could become the new Schelling point for cryptocurrency users.

Yours,

-Stanislav

Haha, agreed. Not impossible for another (and perhaps better) cryptocurrency to come along and take the same role. Though I find it interesting that this hoard of coins has never been spent, even in the $30 bubble. My own thought would be these hoarders are expecting Bitcoin prices to go much higher, and perhaps plan on spending their Bitcoins rather than dumping them en masse.

Dear YeahSure,

If the hoarders are clever (and they most certainly are!) they are waiting for the $3000+ bubble. And are running Machiavellian mathematical models to calculate exactly how fast to spend their hoards without igniting panic.

Of course, if a worldwide government crackdown on the exchanges were to begin, the hoarders would have to bail prematurely. It will be a rather ugly sight.

Yours,

-Stanislav

This whole premise is silly. As long as there are people out there wanting cheap bitcoins, there will be demand to soak up any dumping of bitcoins by hoarders. The price will go down a little, people looking for bitcoins-on-sale will buy them, and the price will go back up. In fact, dumping them would create a bubble. There would be sudden supply spike, everyone would rush to take advantage of the lower price, there would be huge volume and only so many buyers would get the lower prices, but they'd spawn a mania and the price would shoot up again. Afterwards it would crash back down to probably about exactly where it was before all the sillyness of dumping began. So all in all a big yawn. Remember there will only ever be 21M bitcoins.

Dear BladeMcCool,

A serious-enough dip in the exchange rate may well cause an exit stampede, where the number of people who care to buy bitcoins at any price abruptly drops to somewhere near zero. Think "tulip mania."

Yours,

-Stanislav

The fact that you compare this to the tulip bubble implies you don't have a good grasp on supply and demand ecomonics. I re-iterate there will only ever be 21 million bitcoins while there can be an infinite number of tulips or federal reserve notes. As long as bitcoin miners are still dedicating hashpower to put transactions in blocks, bitcoin will continue to have its intrinsic value of signed title transfers of accounting units. Which as you'll note was the only value bitcoins had before someone bought a pizza with them. And if they still have an intrinsic value of signed title transfer abilty, then I'm not the only one who will want to own the entire supply, and thus I'll be in a bidding war with at least one other person for the entire supply of Bitcoins.

And you point to the major flaw I foresee in bitcoin's viability after the 21mil bitcoin mark: Hashing power. Currently there are (according to blockchain.info) between 20TH/s and 25TH/s being thrown at the network right now.

All of those hashes being computed cost money, in the form of electricity and wear and tear on the hardware crunching the math. If the people running the huge energy sucking hashes computing rigs are "rational economic actors," they've made the judgement call that the payout from mining (in the form of 50btc random rewards) is worth the cost.

So, what happens when all the coins are minted? The network lives and breathes on transactions getting processed, via the hashing algorithm. Take away the incentive to crunch hashes, and the people drop out of the mining game. Look at what happened to the whole-network-hash-rate when the market crashed last year, shrink by a third.

IMHO, the thing that's really going to kill bitcoin after the early adopters and thieves cash out was the decisions to untether the miner from the wallet app and move to pooled mining.

It could still recover, as a home of "true believers" but I don't expect this to play out well as people hit their sweet point and cash out, but even then, it'll only live till computers get advanced enough to break it... every good cryptography algorithm has been eventually broken by increasing the amount of processing power thrown at it, so if trends keep up, even the true believers have maybe a decade to play with their toy.

Dear BladeMcCool,

I know very well that it is possible to grow a nearly-infinite number of tulips or to print endless pieces of toilet paper money (federal reserve currency), while there can exist no more than 21 million possible Bitcoins. My prediction was about sudden future jumps in the amount available for sale on the market, and their likely effects considering the herd mentality of a typical speculator. Let's make one thing clear: I like the idea of Bitcoin, and want to see it succeed. But I see the immense influence of a handful of users as a serious hazard.

Yours,

-Stanislav

This analysis is fatally flawed. The paper does not distinguish between "addresses" and "owners". In Bitcoinland, MANY users keep their money in ewallets, which are shared wallets controlled by a 3rd party. Under blockchain analysis, it will appear as though one "owner" possesses tens or hundreds of thousands of coins and a careless observer will conclude that the wealth must thus be concentrated in the hands of that owner. In reality, the huge balance shown in one blockchain account actually belongs to thousands of depositors. Ignoring this dynamic was an amazing oversight of the authors.

Dear Erik Voorhees,

I eagerly await your paper, based on a new and improved analysis.

And the burden of proof is on Bitcoin enthusiasts to show that there is no Great Satoshi Hoard. Its existence is a near-certainty based purely on the facts of the slow initial ramp-up period, when miners were few and difficulty was low.

Yours,

-Stanislav

I think you got the scientific method backwards wrong! It is not I who have to defend anything or write a paper. I can simply point to an non true preposition in the paper and the authors can choose to defend their conclusions or ignore the statement at will.

The fact is they did not account for change transactions, and they did not account for pooled accounts, and they did wrongly state impossibility that transactions may use accounts from several owners. Thus, this paper is not a mathematical proof that the joined account "owners" are in fact single owners.

However I do thing it is very likely they are 🙂

Just to keep the logic straight. Cheers.

Dear Vans,

You are quite right that the paper does not rise to the level of a mathematical proof, especially considering the fact that it contains only the final results of a long series of calculations. However, Ron and Shamir have told us almost everything that we would need to know in order to repeat said calculations - considering that the block chain is public knowledge.

Ron and Shamir's paper is not a watertight proof, but it is strong evidence for an already-strong hypothesis: that early miners obtained and still control most of the presently-existing Bitcoins. And are sitting on them, waiting to get mind-bogglingly rich without ever again doing much of anything.

Yours,

-Stanislav

One way of diffusing that "get mind boggingly rich" idea is to start alternate crypto currencies

Call them litecoins. Call them ripples call them what you want

Already there are venture capitalists investing in the ripples experiment I understand

If you look at hoarding value of bit coins - say anywhere between 0.5 to 1 billion USD versus 'the actual commerce day to day , the actual commerce would be nothing

So bit coins are just being hoarded ...not just by early adopters, but by who ever buys this tulip mania

True ...lite coins and ripples are much less accepted in real commerce, but the bunch of venture capitalists behind ripples and others behind other currencies could easily reverse that situation

I'm beginning to believe that the bit coin experiment has been allowed to succeed so far and even the fincen paper has sort of regulated and NOT banned crypto currencies for this precise reason

There is more drama left and we have seen only the first few scenes here

This topic comes up from time to time on other forums, so I'm not at all surprised that "early adopter cashing out" is a topic here.

Even assuming someone has a large balance - assuming of course the data is truly representative of actual balances - even a wallet containing 1,000,000 BTC only amounts to 4.7% of all coins that will exist in the system.

While "dumping" would certainly hurt the market in the short-term, it would allow all those envious people a second chance to put their money where their mouth is, and snatch up some bargains. A large sell transaction would also hurt the seller, as depressed prices with no bids to prop them up would result in an aggregate price much lower than a slower liquidation could.

So, while an early adopter most certainly COULD sell everything they own - I see little logical reason why anyone would, especially in large amounts over short periods of time, given the obvious market implications.

I'm afraid I'll have to file these objections into the same bin that includes "what if the entire internet is DESTROYED, then bitcoin will be in trouble" ideas. If we're in that sorry of a state, bitcoin will be the last thing you'll be worried about.

Oh, and while we're on the subject, you know what else is 'hoarded' and has the same distribution characteristics? Gold. I think we're in good company there.

The 'flaw' or 'kill switch' is nothing less than a large holder of UST being able to dump it all at once on the market.

Yes it can happen

No it is not likely

A dump only affects value, not the intrinsic properties of the Bitcon protocol. There is no guarantee at all that a dump would kill Bitcoin. Frankly, I would load up some more (better chances than the State Lottery).

If you are scared of the kill switch, invent the Bitcoin-P. If you don't care for fear mongering, keep 'hoarding' or just enjoy your live while Bitcoin may or may not become a success. What we exactly don't need is 'democratic' decisions to neutralize someone's coins. That's something the government already does on a daily basis.

Dear Democraatus,

> Yes it can happen. No it is not likely.

I dare say it becomes ever more likely, as the total in fiat currency that could be vacuumed up by the hoarders continues to grow.

> A dump only affects value, not the intrinsic properties of the Bitcon protocol.

I suppose we could philosophize regarding whether users' willingness to remain users of a protocol is an intrinsic property of the latter or not. The fact is that if Bitcoin were to start leaking value rapidly enough, there would be a catastrophic stampede of people eager to get the hell out and back into state-fiat. Whether there would remain some future for the elegant system after such a stampede, I cannot say: but it is likely that most of the existing value pumped into it by ordinary users would be permanently lost.

> What we exactly don’t need is ‘democratic’ decisions to neutralize someone’s coins. That’s something the government already does on a daily basis.

You know, inflation and devaluation are not the only things that suck about state-backed fiat currencies. Seigniorage also sucks. Bitcoin has been implicitly pushed as seigniorage-free - that no handful of well-connected people earn a giant reward just for being associated with the process of its creation. This has turned out to be false, and I, for one, am disappointed.

Yours,

-Stanislav

I am in the minority of users with a relatively high balance. I came to the same conclusion highlighted in this article a while ago. While Bitcoin is a perfect digital currency (a metaphoric digital goal) it came into existence very quickly unlike gold. While I agree early investors in Google or Apple deserve to profit immensely from there foresight and early investment, it must also be understood it was the earlier adopters that benefited not just a hand full of adopters.

The definition comes down to who are the early adopters? If the early adopters are still classified as the mega Bitcoin rich, then people adopting Bitcoin now are laggards and the ponzi is in play.

I prefer to think of people coming to Bitcoin today as early adopters, the result of that is the problems highlighted in the article are then true.

In conclusion Bitcoin will crash, and build up again (it will only become stable when the mega rich have there wealth eroded).

In the mean I don't like the idea of Bitcoin-A but would like to see a new currency that had a creation rate that resembled a Gaussian curve.

Dear Tim,

Thank you for your honesty. It is a rare breath of fresh air.

Yours,

-Stanislav

"In conclusion bitcoin will crash, etc..."

Lots of hubris, but no comment on whether you'd liquidate - so, are you in for the long haul or is the BIG SELLOFF coming? Inquisitive minds would like to know.

Please, offload your coins - I can put them to much better use 🙂

Dear TraderTimm,

> so, are you in for the long haul or is the BIG SELLOFF coming?

What possessed you to ask this question? Do you really imagine that a Satoshi Hoarder planning The Big Sale would answer truthfully?

Yours,

-Stanislav

>Most bitcoins are, in fact, in the hands of a very few people. Are you surprised? I’m not.

The 'big owners' are actually just web based wallets and exchanges where many users have their coins deposited.

Dear osmosis,

> The ‘big owners’ are actually just web based wallets and exchanges where many users have their coins deposited.

Please explain the fat owners (address clusters) which have very low transaction counts. Specifically, "F", "H", "J", "M", "O", "P" in Table 7.

Yours,

-Stanislav

They *could* be cold wallet storage for the web based wallets and exchanges.

Please also remember that the total 'accumulated' of A-S comes in at over 14Million coins. ie - the figures in table 7 are not 'balances'

Dear jjj,

Very cold storage indeed. Near "absolute zero." See "J" and "P," with their single-digit transaction counts...

Yours,

-Stanislav

[...] Loper’s article lays into Bitcoin without really addressing any of the other critique, as usual: http://www.loper-os.org/?p=1009 [...]

[...] Loper’s article lays into Bitcoin with out genuinely addressing any of the other critique, as common: http://www.loper-os.org/?p=1009 [...]

The U.S. financial system is similarly dominated by a few big names. According to wikipedia, the top 20% of Americans owned 85% of the nation's wealth in 2007. Why would you expect the Bitcoin financial system to be any different? And why would you expect there to be a big sell-off, when it obviously would be counter to the interests of the big coinholders? Even if the big holders of bitcoins are nefarious, surely they would rather have money than be bankrupt.

Think about what would happen if China dumped all its U.S. treasuries on the market at once. Or if a few of the important families around here dumped all their investments in U.S. companies at once. Every economy has a "kill switch." After the events of 2008, it's almost mind-boggling that people could be surprised by or unfamiliar with the concept of systemic failure. But apparently people have to keep re-learning the lessons of history, generation after generation.

Dear cmccabe,

Most U.S. dollars might be in the hands of a business elite, but they at least conduct some useful commerce, and don't act as a monolithic whole. The situation with Bitcoin is more analogous to a scenario where most U.S. dollars belong to a janitor working the night shift at the national mint. The Satoshi hoarders conduct no useful commerce or industry; they hold their coins purely by virtue of having mined when difficulty was very low. They add no value to the system, yet have in their hands a cheque that, were it cashed, would bleed a great many users who have invested actual wealth into Bitcoin exchanges.

Yours,

-Stanislav

If the rest of the non janitors ..er... the late adopters , did NOT buy bit coins , the early adopters would be left with a lot of gaming cards and a huge crappy ledger

The very fact that rest of the crowd latched on to this idea ...or that the early ones marketed this idea , is the beauty of this bit coin saga

Dear New to coins,

Bitcoin (in the everybody-uses-a-few-centralized-exchanges sense, not the cryptocurrency per se) is the first peer to peer pyramid scheme. The pyramid has no clearly-identifiable apex, and so the participants like to imagine that it might be infinitely tall.

This is a crying shame, because cryptocurrencies are potentially useful.

Yours,

-Stanislav

@stanislav

Please tell me if I'm missing something here. Let's go with all your assumptions being true:

We take the Ron/Shamir paper at face value and accept the vast majority of Bitcoin is in the hands of very few;

These mega-hoarders are all in it together and are NSA operatives whose sole intention is to selflessly 'press the button' to devalue Bitcoin to virtually nothing (I say 'selflessly' because with that volume they'll get virtually nothing for most of it as has already been pointed out).

OK, granted. Let's say this is all true.

Also, the latter part of your piece points out how how stubborn, idiotic and head-in-the-sand, how impervious to reason and worthy of your pity Bitcoin 'believers' are. OK, let's grant you that too.

So the time comes when the 'trigger' is deliberately and maliciously pulled. If the 'believers' stay true to character refusing to accept that the end is nigh how are they likely to react? My guess is they'll continue to be 'stupid' , refuse to see 'the writing on the wall' and go on a Bitcoin shopping spree. Doh, how stupid are they?!!

Oh, but wait a minute... Won't that mean the price will rise again from the ashes? It could rise steadily, fast, slow might go wild for a bit then eventually settle again - maybe near to where it is prior to the 'trigger', maybe somewhere else entirely. Who knows? I certainly don't. But I'm not the one claiming to.

Am I missing some essential aspect of your explanation to back up your assertion that such a scenario would result in killing Bitcoin dead?

You may be right in that seeing the price go below a certain point would be the last straw for enough to crawl away with whatever they managed to get back from their holding never to return. But the veracity of the responses in any discussion such as this one (that leads people like you to label Bitcoiners as idiots) illustrate the strength of belief. This isn't 'just' a commodity with typical professional speculators. From what I can see a lot of its users for ideological reasons really want this to succeed and believe in it.

If the perpetual onslaught of articles such as yours are failing to shake that belief I can't see a price crash, regardless of magnitude, doing so either. Any economist will tell you unbacked currencies only have value to the extent people believe they do. On that basis I'm happy to back the strength of belief I see in Bitcoin.

Sorry to tell you, you can no longer correctly write "I presently own a total of ~0.1 BTC". See: https://blockchain.info/address/14HRdapiCevEs155gGGb6iPdps4fx1XszL

Thanks for the essay! I think it is potentially a very important topic and your essay is right to focus on it.

Dear Zooko,

Thank you for your donation! I am glad to hear that you enjoyed this piece.

Yours,

-Stanislav

Alpaca socks? I'm pretty sure there is no such thing. I've certainly never seen an alpaca wearing them.

I wish I had alpaca socks, they seem so useful

Very interesting discussion and thank you for the article, Stanislav.

Could the Bitcoin time bomb conceivably be defused by a proliferation of Bitcoin forks, something similar to Freicoin for example. I would tend to see the existence of several Bitcoin-type networks as diluting the dangers of a sudden dump of Bitcoin by the Saatoshi crowd to the idea of cryptocurrencies.

Of course a survivable cryptocurrency should not have the (rather stupid) fixed ceiling of coins ever to be created. That ceiling should be a moving target which rises in function of adoption of the currency and use in actual commerce. The result would be a more stable (if less exciting) currency.

Freicoin solves the question of what happens to mining after all coins have been created, by a rather elegant solution: a demurrage to be dedicated to rewarding miners for their continued activity. Unfortunately it did not solve the fixed ceiling problem, and the decision to give away a large number of coins to social causes seems a bit off target for a currency that wants to be widely adopted in commerce.

Is there anyone who's up to creating a currency that does not have the shortcomings of Bitcoin?

Dear Sepp Hasslberger,

People with any kind of savings are fleeing from traditional money to precious metals, Bitcoin, etc. because they don't like being robbed. Inflation is theft, plain and simple. At the end of the day, you and I have less value and the man with the printing press has more.

See Moldbug's battery analogy:

Bitcoin's deflation isn't a bug - it's a feature. I doubt you are going to convince me (or Bitcoin users) that the value of my money slowly melting away for no reason at all is a good thing. But you are welcome to try.

"Mining" is a necessary evil: its sole purpose is to distribute the initial supply of coins in a more-or-less fair way. If a handful of people started out with obvious control over the entire 22 million BTC, very few people would be interested in using the currency. My argument is that a milder version of exactly this scenario did in fact happen, albeit with plenty of obfuscation.

Yours,

-Stanislav

I won't dream of convincing you you should prefer to own depreciating assets instead of appreciating assets; that would be silly.

What I would suggest, however, is that you consider the battery analogy more carefully: if inflation is meant to correspond to getting less energy back out of the battery than has been paid in, what, pray tell, would deflation correspond to?

Dear nope,

> what, pray tell, would deflation correspond to?

Deflation corresponds to a situation where you originally purchased and charged a large battery so that it might power a Univac for several seconds, but now you can buy a 12-core Pentium that will run off the same battery for several hours, performing more useful computational work by many orders of magnitude.

Alternatively, the world might change in ways which cause batteries and the charge stored therein to become more widely desired and valued, without any substantial breakthroughs which make batteries easier to manufacture. But this is more-or-less equivalent to the situation described above.

Inflation accounts not only for rising prices (in fiat currencies,) but also for prices which stay constant or simply fail to drop - for goods whose production in terms of actual resources has actually become cheaper over time. As discussed, for instance, here.

Yours,

-Stanislav

I generally agree that a small group shouldn't hold such a huge amount of coins simply based on being early to the system. That is a Ponzi, nothing else. I would prefer a virtual currency that has a democratic distribution system right from the beginning. Either a large group of people should get it as a gift or for something useful like donating blood.

Now if the original idea was to create a currency (and not just making the early adopters rich) why haven't been the early coins used? Wouldn't it make sense to distribute them rather freely or for good deeds and make it useful as a currency so they would be held among many people? That is what a currency is for. Not to mention it would have helped with the popularization of the whole Bitcoin idea.

But I don't agree with Stanislaw that right now it would kill Bitcoin. The article was written when price and hype was much less. At $140 the current hype is so much that a 2 million Bitcoin dump would be probably preferable. Why?

1. Lots of newcomers have to experience a crash. They think their investment can only go up. Once they survive a crash, they will know better.

2. An early crash would help with the price discovery. Because too many coins are horded, it is hard to figure out what is the correct evaluation of a Bitcoin. Similarly, when 80% of a stock is held by board members, the stock price's movement is very limited downward.And it is easy to squize shorters.

So if such a dump would occur, the price could fall 80% or even more, but because of the current hype it would recover rather quickly. Maybe not up to $140 but to $80. And the added value would be that there would be more coins in circulation and more even distribution.

Dear Pepe,

> a large group of people should get it as a gift or for something useful like donating blood.

You are welcome to start "BloodCoin" - a Bitcoin alt-chain where the Red Cross gets to pre-mine a fortune. This is extremely easy to do: fork the Bitcoin client source, re-brand it with a new name, etc. One example: TerraCoin.

But be prepared to curse the world when you discover that no one is particularly eager to accept BloodCoins in exchange for dollars, alpaca socks, or cocaine. Or much of anything else.

The only alt-chain coin I know of with an appreciable market value is LiteCoin. See if you can figure out why. Offering users some actual practical incentive is very much the only way an alt-chain might stand a chance against Bitcoin proper. But once again, you are welcome to start a charity-based alt-chain. Bitcoin users will not burn down your house.

Yours,

-Stanislav

You didn't get the point. It wasn't about the donation, but the wide distribution what counted.

Well, here we are, the crash has happened. 2 days ago from 266$ it crashed to 105 closing around 130. The next day it crashed once more to $50, bouncing back to 120-140. Currently it is around $90.

Lots of coiners agree that this flush was needed and it will separate the greedy speculators from the real users. I think there is going to be another, even bigger crash. Some people needs to experience pain twice to learn from it.

Also, hedge funds got into the action which will make price volatility to increase. Some venture capital firm realized that "hey, we can start our own currency?" and they are working on it. In the long run that means competition and lower prices for Bitcoin.

A real alternative (although I like LTC) is ppcoin. I am still learning about it. Most coiners don't understand history or psychology, thus they were taken by surprise when the crash happened...

The sequel to the story would be that dr. Evil originally does as instructed by NSA, but later falls for a great looks... head turning .... Long legs ... Greek girl friend who is a poet. the two decide to give NSA a slip and go to remote Africa with all the bitcoins . signature keys and wallets are hidden in book between the verses. The NSA agents strip search the girl friend which makes the male moviegoing audience very happy and feminists very sad... More twist is added as There is this evil banker / crony capitalist who is bankrolling the next bit coin / hit coin. Evil banker is interested in the demise of dr. Evil and ms. Greek but not in the demise of the crypto itself. Banker helps girls friend escapte so that she will lead to the book. All ends when the girl friend runs away from the agents with the book, a chase ensures, the book is accidentally tossed at an speeding train and all paper wallets ( ok the book of poems ) is shredded to pieces to be lost for ever..... The ending scene shows a poor widow go up to a baker and buy bread for her bitcoins and the baker returns her half the bit coins...preplexed she asks why give back half when the prices have always been such and such and the baker says that the whole world has benefitted as 10 million bite coins were lost forever the earlier day and the currency has doubled overnight !!! Movie tickets on bitmovies dot bit and cryptcoins dot kit the bit and kit TLD s being new to this world ...

Hi Stanislav,

I'm not sure how you meant to use the term 'built-in' here but I suspect that we should not call it built-in, rather, we should be called inherent (or an emergent property of the transaction history) in order to not get confused with such kill switches in fiat currencies. A qualitative difference with fiat currencies is that there is a ceiling to how many Bitcoins can be dumped in the market, while with fiat currencies, there is no such ceiling (via printing).

The implication is clear: someone could analyze the transaction history of Bitcoin, determine they are not happy with the concentration of coins and consequently the power to dump them, and not use Bitcoins. With fiat currencies, you would need to know the intentions of those with power to print money.

Yours,

- Alexis

Hi Stanislav:

Have they run their scripts on the blockchain data more recently? In other words, has the big rise in interest and price and "crash" and subsequent apparent stabilization of BTC/USD "spread out" the wealth much?

[...] http://www.loper-os.org/?p=1009 – Warum Bitcoin ein Ponzi-Schema sein könnte (Englisch) Share this:DruckenE-MailGoogle +1TwitterMehrFacebookGefällt mir:Gefällt mir Lade... Dieser Beitrag wurde unter Zum Nachdenken abgelegt und mit Bitcoin, Coin, Kryptowährung, Miner, Ponzi Schema, Satoshi, Schneeballsystem, Vorsicht verschlagwortet. Setze ein Lesezeichen auf den Permalink. [...]

[...] else, then the Bitcoins may already be out of the hands of the U.S. government. Failing this, it would be possible for a large number of Bitcoin users to agree to fork the blockchain and treat these 600,000 [...]

Not true. If the price is (anticipated to be) zero (as is the intrinsic value) there is no one left with incentive to trade / transfer. Your relative have no use of bitcoins (or any other sequence of 0's and 1's).

The recent Congressional hearing which seemed to view BitCoin favorably is a repeat of the strategy used when the US Treasury said NORFED (platinum/gold/silver based currency) was legal. It is simply a ploy to let Bitcoin run a bit longer to identify the players before Uncle pulls the Sucker Punch and the Secret Service siezes all Bitcoin assets and makes arrests..

Ugh, I'd be careful of that hypocrisy if I were you! Your entire proposal for shitcoin is predicated on theft, scamming and fraud being reprehensible. Yet what the fuck do you think Bitcoin's creators, its apologists and hoarders of any currency are if not scammers, fraudsters, and thieves respectively?

Do you seriously think you can get away with first condemning fraud and thievery then saying you don't give a damn? How do you justify that complete lack of principle to yourself? If not that you're saying nonsense and are too ignorant to understand what's coming out of your mouth.

Here's the level of ignorance and stupidity you portray. You're trying to conjure software solutions to mental (socio-political) problems, *without even acknowledging the nature of the problems*. You don't know what the fuck you're talking about and as a result STUPID is coming out of your mouth!

You deserve a hard slap for this.

This is an astonishingly stupid statement. Do you even know what the real bills doctrine is? It's what you're proposing, that anyone can create cash at need so long as it corresponds to real value out in the real world. And it's great! It's decentralized as hell. Way more decentralized than Bitcoin's miners.

Only you know what? There's a vast difference between referencing the real bills doctrine in the middle of other crap you've confused with it, and discussing it intelligently as if you know what the fuck you're talking about!

The way you talk about currency, and especially about the CREATION of currency, without ever actually *addressing the topic*, makes you sound like a retarded yokel who wants to put together a computer without knowing the difference between RAM, a Hard Drive, and a CPU!

Who gets to create cash in some currency? And in what amount? These are CENTRAL issues to any currency. In the case of Bitcoin, it's "early adopters" and "up to a preset amount then not at all". Obviously any ponzi operator is going to rig the scheme to benefit themselves so that's hardly surprising.

Yet now you come along to tell people that there is a catastrophic problem with one of the central ideas of the Bitcoin "currency" as a currency. With who got to create the cash and in what amount. And you mention this WHILE ENTIRELY AVOIDING THE ISSUE. How stupid are you? You're not providing insight or analysis, you're providing the confused ramblings of a madman!

+

What's actually happening is you're sounding like a damned Psychopath. Like the typical con man, spin doctor and cultist. Like a damned *right-libertarian*. Simple and obvious concepts like "who should create money?" now appear entirely beyond you with the brain damage you've absorbed by hanging out with Psychopaths. Because the Psychopath's answer is "I should, and nobody else!" ... you know, Satoshi's answer! The con man's answer! And because you're not so profoundly retarded as to provide THAT answer to the question, instead you try to provide *NO* answer by *AVOIDING* the question.

That's not slap-worthy stupidity, Stan. That's *punch* worthy. The only way your fevered confused madman's ramblings would be any worse is if you actually DID provide the con man's answer!

Your brain is LIQUEFYING from hanging out with RETARDS. Your PRINCIPLES are liquefying!

I know this is old but I feel I should pitch in.

1) It is trivial to assume that the satoshi-gang of early miners ARE sitting on tons of bitcoins. And of course, should they ever decide to activate the "kill-switch" as you called it, the prices would go tumbling down. Enacting mathematical proof of this inevitability is an exercise in futility.

2) If this were to ever happen, it would definitely not be the end of bitcoin. I speak for myself, and I'm sure thousands of others agree, if bitcoin's price would drop to pennies, it would be my lucky strike. I would jump in and start buying en-masse. The fact that bitcoin is NOT a company's stock makes it invulnerable to a classic run-on-the bank. Its intrinsic value as a means of easy and fast means of transaction, and even as a store of value still holds regardless of how much people price it. In fact, with the relatively small number of merchants willing to accept bitcoin, it's definitely overvalued at > 500$. You would have to be out of your mind not to realize that the artificially inflated price is caused by speculators in for the quick cash, rather than true and genuine community adoption. Nevertheless, adoption is steadily rising.

The real question is, why would someone invest so much effort into creating a currency that has such untold potential, and then activate the kill-switch.

If the only thing that could destroy bitcoin lies in their hands, it would be absolutely stupid for them to do that. At any point in time, their Exiting the market would lock them out of it. Because:

a) That would not kill bitcoin (as per the above)

b) If they hadn't done so, they would be sitting on increasingly valuating assets, in terms of number of merchants willing to accept it, and amount of goods you can purchase with it.

c) Would you dump instruments in an economy that you potentially control in return for instruments in an economy you have almost zero-control over, and that has proved to be inefficient over and over again?

The only thing that could potentially drive the satoshi gang to activate the switch as per your articles is the possibility that they may be NSA trying to discredit cryptocurrencies. Aside from the james-bond conspiracy theory hints that I find to be absurd, it would be absolutely counter-intuitive. They have practically opened a can of worms with such foolish act. Contrary to what you are proposing, starting a cryptocurrency which even they can't destroy if they tried (as per the above), would only prove to the world that indeed decentralized currencies can actually work.

Dear Francois,

Well-reasoned argument! The Great Flood, at this point, wouldn't drive the price to zero, quite true. It would merely drive it down to 2010 levels.

Which would handily kill (or at least, seriously damage) all of the 'meatspace' businesses currently taking in sizable amounts of BTC, in just the same way as a 1000-fold devaluation of the U.S. Dollar would destroy many businesses which use that currency (as well as driving anyone whose savings are denominated in it into penury.)

Yours,

-Stanislav

Stanislav.

You're wrong. Your bitcoin-P scheme is perfectly analogous to a plan by people concerned about inflation (which is just dumping dollars anyway) deciding that they will only accept money minted before a certain date, or with serial numbers exhibiting a certain property, or whatever. For the same reasons that scheme has not been tried and would not work, bitcoin-P would not work. We can generalize from this to show that your larger criticism of bitcoin based on this paper is also wrong.

[...] people. In crypto currencies like Bitcoin, wealth is concentrated to such an extent so as to be an existential threat, and other crypto currencies have been similarly criticized. “If one person can dump and destroy [...]

[...] people. In crypto currencies like Bitcoin, wealth is concentrated to such an extent so as to be an existential threat, and other crypto currencies have been similarly [...]